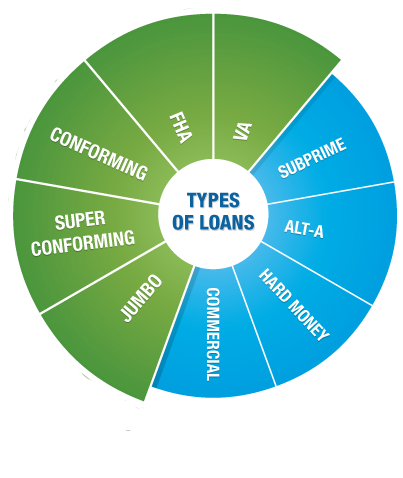

In today’s market, there are almost too many loan options, and choosing the right one can be daunting. Capital City Home Loans understands how overwhelming it can seem, but we want to provide you with some basic information to help you weed through the more common loan options.

Deciding Between a Fixed and Adjustable Rate Mortgage

With a fixed-rate mortgage, the interest rate for your loan is the same on day one as it is on the day you make the last payment, whether that’s in 10, 15, 30 years or more. If you get a fixed rate loan with a 6% interest rate, your interest rate will remain at 6% forever — unless you decide to refinance.

With an adjustable-rate mortgage (ARM), your interest rate will change at set intervals during the life of your loan. If you start with a 6% loan, that interest rate can climb to 7%, 8%, 11%, or fall to as little as 3% or 4% — possibly in a few short years. This can represent an increase or decrease of hundreds of dollars on your monthly mortgage payment, and none of that increase is going toward the principal of the loan. In other words, ARM loans can be a little trickier.

Fixed Rate Benefits

- No surprises: From day one of your mortgage, you know exactly what your payments will be through the life of the loan.

- Low rates are locked in: If you have a fixed-rate loan with a low interest rate, you’ll always keep that same low rate.

- Long-term savings: Though the interest rate on a 30 fixed-rate loan can be higher than the starting rate on an ARM, you’ll probably save money in the long run. The longer you hold your mortgage, the more sense it makes to lock in at a fixed rate — assuming that rates are low.

Adjustable Rate Benefits

- Low Initial Payments: Most ARMs have an initial period (usually between one and five years) during which their interest rates are significantly lower than fixed rate loans. During this period, your monthly payments will be comparatively low.

- Rates can drop: If interest rates go down, your monthly payment can drop as well. This can make ARMs especially attractive when interest rates are high, and possibly poised to fall.

- Short term gains: If you’re certain that you’re going to sell your home within a few years, the low initial rate offered by an ARM can make it a good option. You’ll sell before your ARM readjusts to a higher rate.

Deciding Between a Jumbo and Conforming Mortgages

The major difference between jumbo loans and conforming mortgages is size. Conforming loan limits are set by Fannie Mae and Freddie Mac. Jumbo mortgages are all loans that are higher than current conforming loan limits. Fannie Mae has four sets of loan limits for one-to-four family homes. Their most common limit is $417,000 for most of the continental US. This “general” limit increases to $625,500 for Alaska, Hawaii, Guam and the U.S. Virgin Islands single-family properties.

With jumbo loans, it’s important to remember that you build equity at a slower pace because payments during the first several years go largely toward interest rather than the principal balance. With conforming loans, note that if you choose a variable interest rate for your line of credit balance, your monthly payments may increase or decrease as interest rates fluctuate.

Jumbo Loan Benefits

- Obtain financing for loan amounts higher than the Fannie Mae and Freddie Mac conforming limits.

- Get the convenience of one loan for the entire loan amount.

- Choose from a variety of loan options.

- Have ongoing access to your available equity without reapplying.

- Choose whether your line of credit balance will be charged a variable or a fixed-interest rate.

Conforming Loan Benefits

- Have ongoing access to your available equity without reapplying.

- Choose whether your line of credit balance will be charged a variable or a fixed-interest rate.

We hope this has been a helpful overview of some of the different loan options available, and helped you decide which loan might work best for you. Give Capital City Home Loans a call today with any questions.