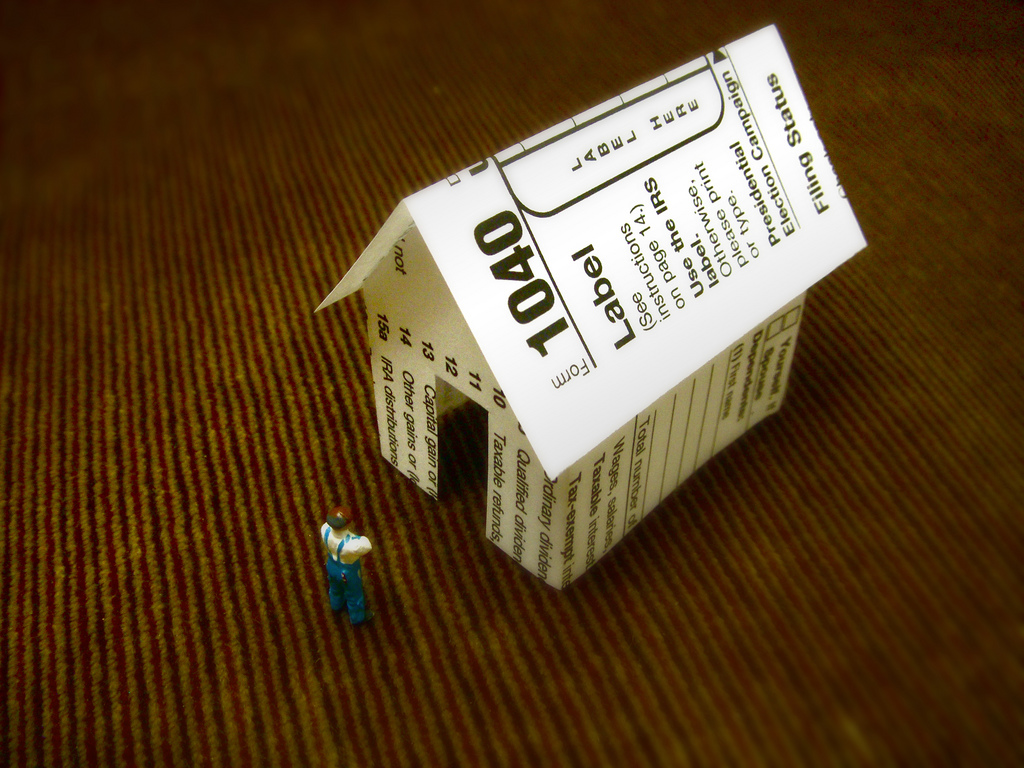

Tips to Successfully Restoring Your Credit After Tax Liens

A recent article from CNBC brought to light some of the common misconceptions about the realities of tax liens and the effects they have on your credit score. A tax lien, which is a serious strike that occurs when you neglect or fail to pay a tax debt, can be longer lasting than you might expect. Here’s some information and resources that may help if you’re dealing with a tax lien on your credit report.

What is a tax lien and how does it affect my credit?

Tax liens can vary depending on your individual situation. A tax lien can be one of the worst items to appear on your credit report, and can cause your credit score to drop significantly. Essentially, when you fail to pay your tax debt on time, the government can claim all or some of your assets. It can occur at the local, state or federal level.

It’s important to remember that any tax penalty against you becomes a matter of public record, and will negatively affect your credit score. Worse still, under federal law, unpaid tax liens can remain on credit reports indefinitely, though more often, credit bureaus tend to remove them after a decade or so. Once you’ve paid off the debt and the lien is released, it will be removed from your score seven years from the date it was filed.

Because no two credit histories are alike, there is no way to state equivocally how much change removing the tax lien will have or even what an average change might be for any given scoring system. Further complicating the issue is that there are many different credit scoring systems. So, the impact on one system could be very different from another because the numeric scales are different.

Do I qualify to have the lien withdrawn from my credit score? Yes, if:

• your tax liability has been satisfied (you’ve paid what you owe) and your lien has been released;

• you are in compliance for the past three years in filing your individual and business returns, and;

• you are current on your estimated tax payments and federal tax deposits.

Even if you haven’t paid the IRS what you owe, you may be able to qualify for this program if you currently owe $25,000 or less and have entered into a direct debit installment agreement where your payments to the IRS are taken from your bank account automatically.

How do I remove a tax lien from my credit report?

First, it’s important to know that unpaid tax liens, unlike other public records, may remain on your report indefinitely. Because of this, the best way to get rid of a tax lien is to pay your tax debt in full.

If your credit report shows an outdated paid tax lien, you could file a dispute with the credit bureaus, just like you can for other credit report errors. You could also dispute a tax lien on your credit report if you have proof that you should not have been subject to it in the first place.

If the debt has been paid in full, then Form 12277 is your new best friend. As CNBC outlined, there are five suggested tips to ensure the lien is removed from your account using this form:

- Locate your state IRS field collection office. This is where you will be sending forms or asking any questions you might have.

- Search the Internet for IRS Form 12277 and fill it out.

- Call the IRS office and ascertain the fax number. Inform them that you will be submitting Form 12277, and call a couple of days later to confirm they have received it. The turnaround time is about 30 days. If you haven’t received a letter confirming the lien withdrawal, follow up with another call.

- Contact the three credit bureaus, Experian.com, Equifax.com and Transunion.com, and follow their specific step-by-step instructions for submitting the withdrawal. Within 30 days you should receive updated credit reports from each of the three credit bureaus.

- Check each report to ensure that the tax lien was expunged. If any of the three bureaus did not remove the lien, contact the bureau continuously until it’s removed.

The Road to Recovery

Capital City Home Loans wants you to understand how tax liens work, how they affect your credit score and what you can do to deal with them. Because the laws regarding liens can vary, it’s always smart to consult the proper resources, such as the IRS, your state or local tax authority or a credit counselor. Protect your credit by paying your taxes promptly to avoid tax liens appearing on your credit report whenever possible.